Homeowners continue to build wealth. Home price growth is reaching the highest level in more than four decades, pushing equity gains to a record high.

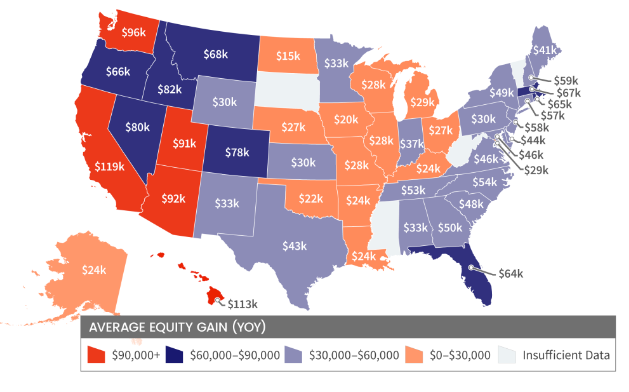

The average home equity gained between the third quarter of 2020 and the third quarter of 2021 is about $57,000, CoreLogic reports.

“Not only have equity gains helped homeowners more seamlessly transition out of forbearance and avoid a distressed sale, but they’ve also enabled many to continue building their wealth,” says Frank Martell, president and CEO of CoreLogic.

Overall, homeowners with mortgages have seen their equity increase by a total of $3.2 trillion since the third quarter of 2020—a jump of 31.1% year over year, CoreLogic reports.

California, Hawaii, and Washington posted the largest equity gains in the third quarter year over year, up $118,700, $112,700, and $96,000, respectively, CoreLogic reports. On the other hand, North Dakota posted the lowest average equity increases at $15,400.

Meanwhile, the number of homeowners with negative equity—where the mortgage on the property is higher than what the property is currently worth—continues to fall. Negative equity decreased by 5.7% when comparing the second quarter to the third quarter. About 1.2 million homes—or 2.1% of all properties with a mortgage—are in a negative equity position, CoreLogic reports.

Source: “Homeowner Equity Insights,” CoreLogic (Dec. 9, 2021)