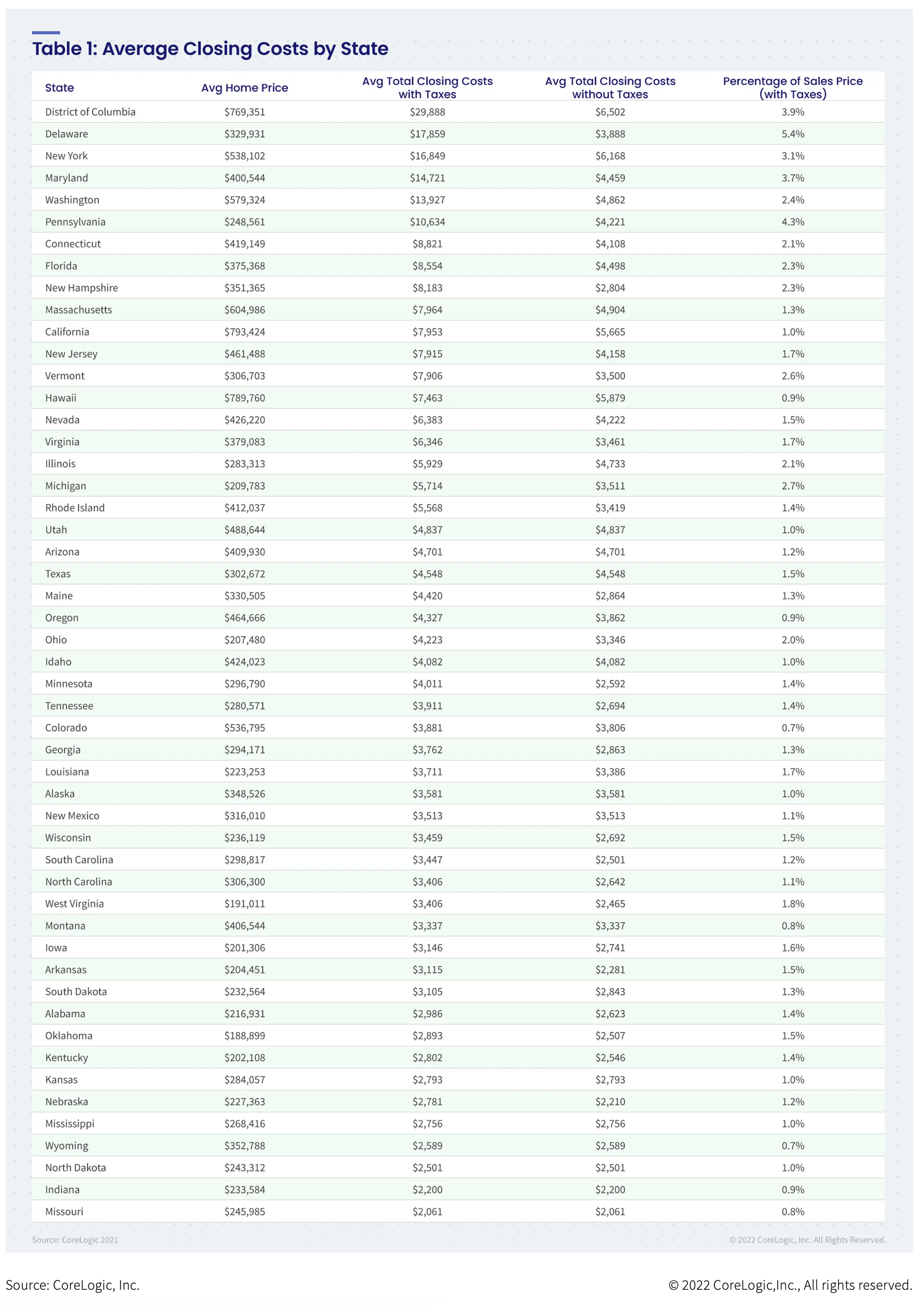

Average closing costs for a single-family home rose by 13.4% in 2021, according to a new analysis by CoreLogic, a real estate research firm. That equates to about $6,905 including transfer taxes and $3,860 when transfer taxes are excluded.

Home buyers also are facing higher borrowing costs from mortgage rates and higher home prices. The 30-year fixed-rate mortgage averaged 5.11% last week, according to Freddie Mac. Since the beginning of the year, mortgage rates have jumped by 1.8 percentage points, which has added about $400 to the average monthly mortgage payment for a median-priced home, according to the National Association of REALTORS®.

What’s more, the average U.S. home price rose by more than $50,000 last year, CoreLogic reports.

“As the mortgage industry comes off two years of record-low interest rates and red-hot consumer demand, lenders are now pivoting to address increasing headwinds from higher loan origination costs and lower origination volumes,” says Bob Jennings, an executive at CoreLogic Underwriting Solutions. “As the market tightens in 2022, it will be interesting to see how lenders and borrowers respond and how these key metrics move.”

Source: “Average Closing Costs for Purchase Mortgages Increased 13.4% in 2021, CoreLogic’s ClosingCorp reports,” CoreLogic (April 21, 2022)