The housing market is heating up again, pushing prices to record highs even after mortgage rates have spiked. Would-be buyers are in shock.

In the housing market today, it feels like what goes up doesn't have to come down.

It looked like home prices were finally cooling off late last year after price spikes that began during the pandemic. Nationwide, prices dipped gradually in the second half of 2022 as mortgage rates climbed in response to rising interest rates. And some areas where a lot of new homes had been built — like Austin, Texas; Boise, Idaho; and Charlotte, North Carolina — saw significant price declines.

Granted, that was a double-edged sword for many people. Higher interest rates tend to bring home prices down, but that’s because they make it more expensive for buyers to borrow money to finance their purchases.

The rate hikes were not enough to undo the big price gains of the past few years, especially in parts of the U.S. where home sale prices already run well above the national average, but the change came as a relief for many people.

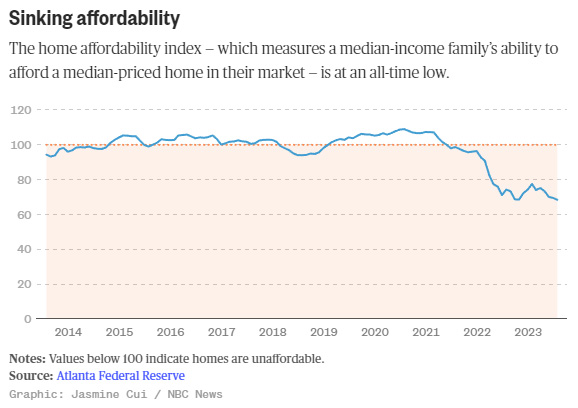

Then something even more surprising happened early this year. Prices started going up again. Potential homebuyers who may have breathed a sigh of relief a few months ago are now staring at an improbable double whammy: Prices are at all-time highs even with mortgage rates at 23-year highs.

The average U.S. rate for a 30-year mortgage was 7.49% on October 5, according to government-backed lender Fannie Mae.

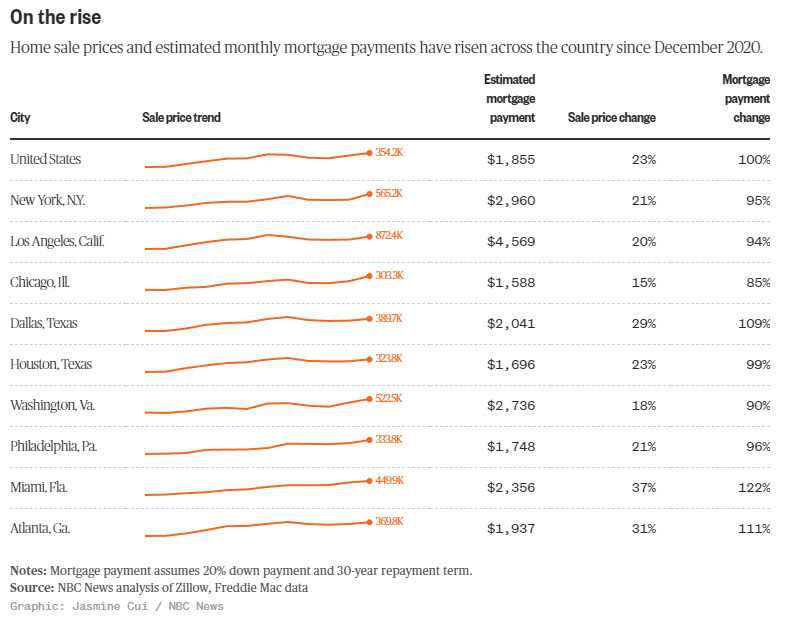

In fact, an NBC News analysis of data from Zillow found that estimated mortgage payments have increased in more than 500 cities since the end of 2020, with payments doubling in more than half of cities.

Shoppers compromise repeatedly, then give up

Tracy Jolson-Halperin, a New York City resident who works in medical device sales, said she and her husband have been looking for a house for a year now. At first they tried to wait, thinking that rising mortgage interest rates would bring prices down and make bidding wars less intense. But that hasn't happened in the areas where they're looking.

They started with a well-above-average budget of $1 million and hoped to find a three- or four-bedroom house near a train line, and the couple felt that time was on their side.

"We had to increase the towns we were looking at, taper our expectations a lot, and increase our budget," she told NBC News.

They initially hoped to buy a house in Westchester, but Jolson-Halperin has accepted that she and her family are more likely to find what they're looking for in Connecticut. She said she’s expecting a two-hour commute to New York City on some days and has considered fixer-uppers and towns with less-impressive school districts.

On some properties, she said, they made offers while dropping mortgage contingencies — the mechanism buyers use as an offramp from a purchase in case certain issues arise — and went as much as $100,000 above the asking price on a house they were outbid on.

None of that worked. She said they've decided to slow down and rent instead.

"We figure we'll rent outside of the city, get to know the towns," she said. "We feel like we missed out."

Jolson-Halperin added: "Prices in the areas that we really liked were just going up and up. It seemed like with every sale the houses were going further and further up and we were starting to get priced out."

As of the most recent data in July, the S&P CoreLogic Case-Shiller U.S. National Home Price Index is at a record high, 1% above its mark from a year earlier. The increase in prices from the last few months has canceled out the late-2022 dip.

In a news release, S&P said prices rose in all 20 of the largest cities it tracks, and suggested they will probably keep going up.

Spiking rates are shrinking supply again

The new problem is that few people want to sell, even if there's never been a better time for them to cash in on their house. The National Association of Realtors says there were about 1.1 million unsold existing homes on the market in August, down almost 15% from a year ago.

Greg McBride, Bankrate chief financial analyst, told NBC News that as rates go up, people who bought their homes years ago and locked in mortgages at 3% or 4% interest rates become less and less likely to move.

That means supplies are low, which has sent prices up again.

"The reversal that we’ve seen in the housing market has come despite rising mortgage rates because the dominant dynamic is the extremely limited supply of homes available for sale," McBride said. "In many markets, that's contributed to higher prices. In others, it's put a floor under prices or limited price declines."

Even realtors are sounding the alarm, since they're not happy with the shortage of homes to sell. In a Sept. 28 news release, National Association of Realtors Chief Economist Lawrence Yun said the supply of homes needs to double just to moderate the recent gains in prices.

McBride said prices will stop rising eventually, but even then, they will probably become stable instead of decreasing much, at least on a nationwide level. Prices could come down in response to higher rates, but that's going to take much longer.

"There will be a tipping point at which higher rates siphon off enough demand that even with limited supply, there's no longer fuel to push prices higher," he said.

"At what point does this very limited supply picture improve? It's probably not going to happen with mortgage rates around 8%."

Source: nbcnews.com