Jumbo loan rates higher than conforming mortgages for 3rd week in a row as spread widens to 16 basis points, latest MBA lender survey reveals

Homebuyer demand for purchase loans picked up last week to the highest level since May even as rates on jumbo mortgages surged, according to a weekly survey of lenders by the Mortgage Bankers Association (MBA).

The MBA’s Weekly Mortgage Applications Survey shows applications for purchase mortgages were up by a seasonally adjusted 3 percent last week when compared to the week before but down 21 percent from a year ago. Requests to refinance were also up 3 percent week over week but down 32 percent from a year ago.

“New home sales have been driving purchase activity in recent months as buyers look for options beyond the existing-home market,” MBA Deputy Chief Economist Joel Kan said in a statement. “Existing-home sales continued to be held back by a lack of for-sale inventory as many potential sellers are holding on to their lower-rate mortgages.”

In a forecast released Monday, economists at Fannie Mae predicted Fed tightening is likely to lead to a “modest recession” in the final three months of 2023, and that sales of existing homes will fall by 16.2 percent this year to 4.213 million. But Fannie Mae forecasters see new-home sales growing by 1 percent to 647,000, as inventory shortages spur home prices and demand for new homes.

https://fred.stlouisfed.org/graph/graph-landing.php?g=15Vsf&width=670&height=475

According to mortgage rate lock data tracked by the Optimal Blue Mortgage Market Indices, rates on 30-year fixed-rate conforming mortgages have been holding steady in June with Tuesday’s average of 6.69 percent down from a 2023 high of 6.85 percent seen on May 26.

But rates on jumbo mortgages too big for purchase by Fannie Mae and Freddie Mac were at 6.99 percent Tuesday, a “spread” of 30 basis points over conforming loans.

For the week ending June 23, the MBA reported average rates for the following types of loans:

- For 30-year fixed-rate conforming mortgages (loan balances of $726,200 or less), rates averaged 6.75 percent, up from 6.73 percent the week before. With points remaining at 0.64 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans, the effective rate also increased.

- Rates for 30-year fixed-rate jumbo mortgages (loan balances greater than $726,200) averaged 6.91 percent, up from 6.80 percent the week before. With points increasing to 0.69 from 0.49 (including the origination fee) for 80 percent LTV loans, the effective rate also increased.

- For 30-year fixed-rate FHA mortgages, rates averaged 6.63 percent, down from 6.74 percent the week before. Although points increased to 1.08 from 1.03 (including the origination fee) for 80 percent LTV loans, the effective rate also decreased.

- Rates for 15-year fixed-rate mortgages averaged 6.23 percent, down from 6.26 percent the week before. With points decreasing to 0.69 from 0.71 (including the origination fee) for 80 percent LTV loans, the effective rate also decreased.

- For 5/1 adjustable-rate mortgages, rates averaged 6.28 percent, up from 6.09 percent the week before. Although points decreased to 1.02 from 1.40 (including the origination fee) for 80 percent LTV loans, the effective rate also increased.

The average spread between jumbo and conforming rates widened to 16 basis points last week, the third week in a row that the jumbo rate was higher than the conforming rate, Kan noted.“To put this into perspective, from May 2022 to May 2023, the jumbo rate averaged around 30 basis points less than the conforming rate,” Kan said.Fannie Mae economists warned in March that stresses on regional banks sparked by the failures of Silicon Valley Bank, Signature Bank and First Republic Bank could make jumbo loans exceeding Fannie and Freddie’s $727,200 conforming loan limit harder to come by.While conforming loans are largely financed by securitizing them into mortgage-backed securities (MBS) and selling them to investors, jumbo mortgages are funded almost entirely by banks, and some regional banks are more concentrated in jumbo mortgage lending than others, Fannie Mae forecasters warned.

Mortgage rates expected to ease

Federal Reserve policymakers expect two more rate increases this year, and then most expect to see the benchmark federal funds rate coming down next year.

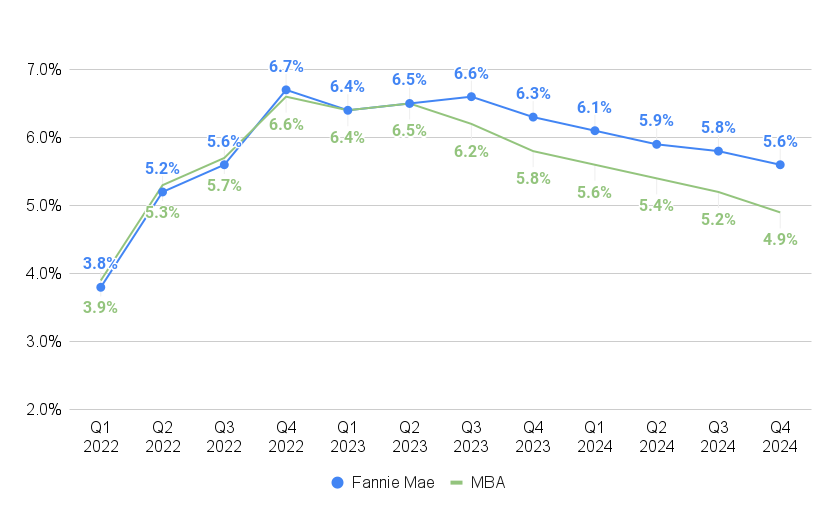

Economists at Fannie Mae and the MBA expect mortgage rates will ease this year and next. In a June 20 forecast, MBA economists predicted rates on 30-year fixed-rate mortgages will drop to an average of 5.8 percent during the final three months of this year. In their latest forecast, Fannie Mae economists don’t see that happening until the third quarter of 2024.

Source: inman.com