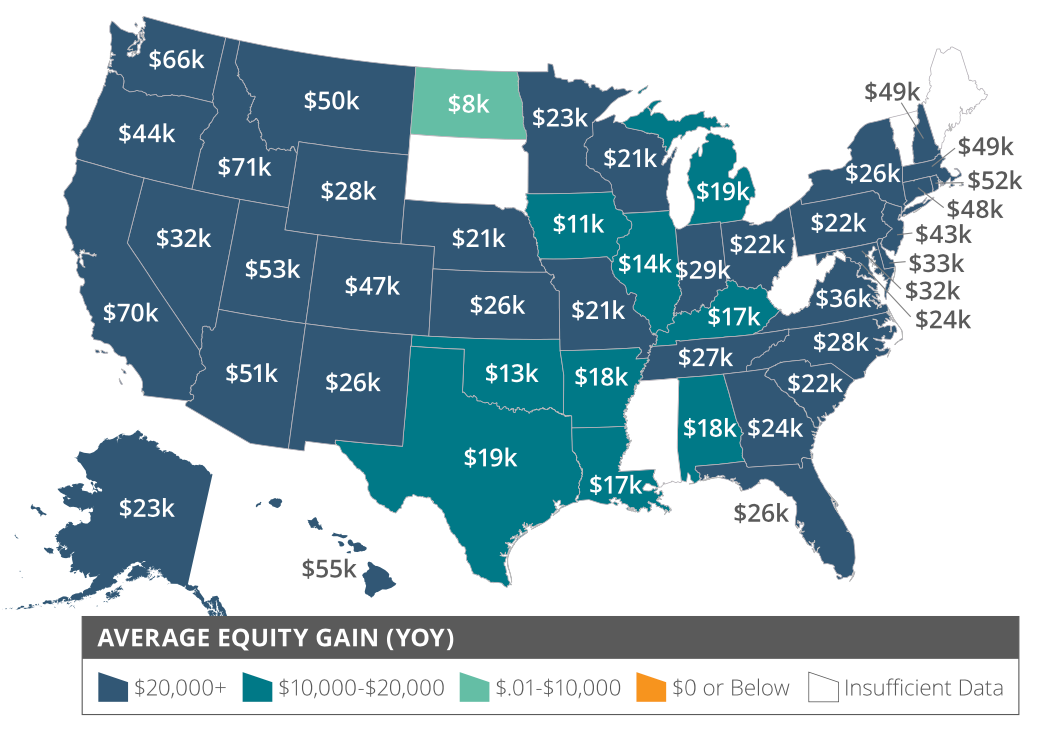

Existing homeowners may be feeling richer since they've received a notable boost to their home equity over the last year. Homeowners with a mortgage have seen their equity climb nearly 20% year over year, according to a new report from CoreLogic, a real estate research firm.

In the first quarter of 2021, the average homeowner gained about $33,400 in equity over the past year, the study shows.

Idaho, California, and Washington saw the largest equity gains at $70,900, $69,600, and $65,800, respectively.

“Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic,” says Frank Martell, president and CEO of CoreLogic. “These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market, especially for older homeowners and baby boomers who’ve experienced years of price appreciation.”

The National Association of REALTORS® reported recently that the median existing-home sales price for all housing types in April was $341,600, a record high for home prices. All four major regions of the U.S. posted double-digit year over year increases in April.

Homeowners who are nearing the end of their pandemic-aid forbearance options but still struggling to keep up with house payments may find selling their home an option over foreclosing. The number of residential properties with a mortgage in a negative equity position—worth less than what the borrowers’ mortgage is—plunged by 24% year over year. Negative equity properties represent just 2.6% of all mortgaged homes, according to CoreLogic.

Source: “Homeowner Equity Insights: Data Through Q1 2021,” CoreLogic (2021)