Mortgage rates barely budged this week, keeping borrowing costs low for summertime home shoppers. Mortgage rates continue to hover near their 2016 averages. “We’re seeing a tug of war happen as the fixed-income market flashes warning signs while the equities market continues to march higher with optimism,” says Sam Khater, Freddie Mac’s chief economist. “The data suggests the economy is weakening but is still on very solid ground, with high consumer confidence and a strong labor market. Closer to home, the housing market continues to slowly improve and gain momentum as we head into the second half of the year, which is good news and should keep the economy growing.”

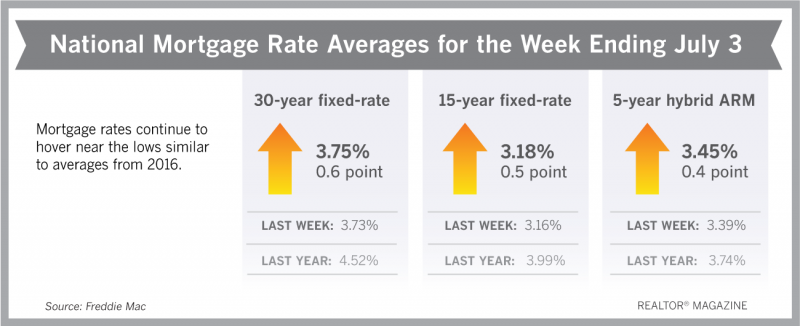

Freddie Mac reported the following averages for mortgage rates for the week ending July 3:

- 30-year fixed-rate mortgages: averaged 3.75%, with an average 0.6 point, up slightly from last week’s 3.73% average. Last year at this time, 30-year rates averaged 4.52%.

- 15-year fixed-rate mortgages: averaged 3.18%, with an average 0.5 point, rising from last week’s 3.16% average. A year ago, 15-year rates averaged 3.99%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.45%, with an average 0.4 point, rising from last week’s 3.39% average. A year ago, 5-year ARMs averaged 3.74%.

Source: Freddie Mac