While Federal Reserve policymakers had forecast 3 rate cuts next year, futures markets see an 85% chance of at least 6 rate cuts after a key inflation metric shows the economy is cooling rapidly

Mortgage rates are continuing a stunning retreat from 2023 highs this week after a key inflation metric showed the economy is cooling rapidly — perhaps too rapidly for those hoping for a soft landing in 2024.

The Bureau of Economic Analysis reported Friday that the core personal consumption expenditures (PCE) price index, which excludes food and energy prices, fell to 3.2 percent in November, down from 3.4 percent in October.

Federal Reserve policymakers want to see core PCE drop to 2 percent and, with the exception of January, the key inflation metric has been trending in the right direction every month this year.

The Fed’s inflation gauge: Core PCE

“As recently as June, core PCE inflation was 4.3 percent, so the speed of the downshift is remarkable,” Pantheon Macroeconomics Chief Economist Ian Shepherdson said in a note to clients Friday. “Moreover, in the three months to November, compared to the previous three months, the core deflator rose at a mere 2.1 percent annualized rate.”

In wrapping up their final meeting of the year on Dec. 13, Fed policymakers released a summary of economic projections forecasting three rate cuts next year.

But Shepherdson noted that the Fed’s latest projections also showed policymakers expected core PCE would still be at 2.4 percent in Q4 2023, “so the risk to those forecasts — and, hence, to the Fed’s interest rate forecasts — clearly is to the downside.”

The CME FedWatch Tool, which tracks futures markets to predict the odds of the Fed’s next moves, shows investors on Wednesday were pricing in an 86 percent chance that the central bank will approve at least two rate cuts by May 1, and an 85 percent chance of at least six rate cuts by the end of next year.

That would bring the Fed’s target for the short-term federal funds rate to between 3.75 percent and 4.0 percent, down from the current target of 5.25 to 5.5 percent established in July. The 11 rate increases the Fed implemented starting in March 2022 brought the federal funds rate to a 22-year high.

Fed paused rate hikes in July

While the Fed doesn’t have direct control over long-term rates, bond yields and mortgage rates have been falling on expectations that the central bank will cut short-term rates next year to avoid dragging the economy into a recession.

“It’s tempting just to say these data are all consistent with the soft landing story and leave it at that, but if the recent inflation trends continue, as we expect, the Fed likely will face the risk of an inflation undershoot to target by late next year or early 2025,” Shepherdson said. “Against that backdrop, markets will push even harder for the Fed to ease by more than their current 75 basis points forecast next year, and policymakers will have little choice but to follow their lead.”

Mortgage rates down 1.23 percentage points

Rates on 30-year fixed-rate conforming mortgages averaged 6.60 percent Tuesday, down eight basis points from a week ago and 1.23 percentage points from a 2023 peak of 7.83 percent registered on Oct. 25, according to daily rate lock data tracked by Optimal Blue.

A year ago, conforming mortgages eligible for purchase by Fannie Mae and Freddie Mac were averaging 6.48 percent, and dipped below 6 percent for a single day this year, touching 5.98 percent on Feb. 2, according to Optimal Blue.

While Optimal Blue data lags by one day, mortgage rates could have more room to come down before the end of the year. At 3.80 percent Wednesday, yields on 10-year Treasurys — a reliable barometer for mortgage rates — were down eight basis points from the day before, and 1.2 percentage points from a 2023 high of 5 percent registered Oct. 22.

It’s too soon to say whether homebuyers are responding to the latest decline in rates — results of the Mortgage Bankers Association’s lender surveys for the weeks ending Dec. 22 and Dec. 29 won’t be released until Jan. 3, 2024. But recent MBA surveys show demand for purchase loans had picked up in five of the seven previous weeks.

With mortgage rates in retreat, economists at Fannie Mae and the MBA think home sales are likely to hit bottom in Q4 2023, but that the U.S. economy is likely to experience a modest recession in 2024 even as home sales pick up.

Lower rates forecast for 2024

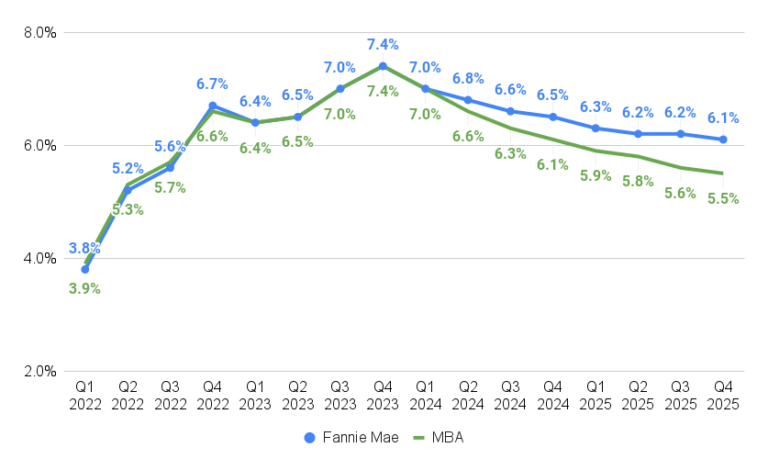

In a Dec. 12 forecast, MBA economists projected rates on 30-year fixed-rate loans will drop to 6.6 percent during Q2 2024, in time for some spring homebuyers to take advantage, and continue falling below 6 percent by Q1 2025.

Fannie Mae economists said in a Dec. 11 forecast they expect 30-year fixed-rate loans will dip to an average of 6.5 percent during Q4 2024, and fall to 6.1 percent by the final three months of 2025.

Source: inman.com